An increase in minimum wage is a cause for celebration for those in the workforce. This is especially because a wage increase is instrumental in bringing those in lower income groups out of poverty in order to lead better lives. While it appears simple, the reality is more complex. There are many overlapping and correlating factors that make up the issue – including workers’ income, their employment status as well as the incidence and depth of poverty.

This article provides an overview of the minimum wage implementation in Malaysia, its impact across various sectors, and the possible solutions that could be adopted by the government and industry players.

___________________________________________________________________________

Many countries make minimum wage a legislative priority in order to achieve the following:

- Reducing poverty or inequality by raising the wages of low-income workers.

- Encouraging growth and productivity.

- Addressing labour-market efficiency issues that adversely affect workers negatively.

Although seen as a timely increase, the announcement of the new minimum wage of RM1,500.00 was met with mixed reactions from the workforce and business owners alike. It was gazetted officially in the Minimum Wages Order 2022 and took effect nationwide on 1 May 2022.

Employers with fewer than five staff members, are given some time to prepare themselves and will only be legally required to follow the new rate from 1st January 2023 onwards. This delayed introduction also applies to employees who take in commission-based wages from employers with fewer than five employees.

Besides that, employers who carry out professional activities classified under the Malaysia Standard Classification of Occupations (MASCO) as published officially by the Human Resources Ministry, will still need to adhere to the new RM1,500.00 rate from 1 May 2022, regardless of how many employees are employed under their care. This means that the minimum wage that employers must pay workers would amount to RM7.21 an hour. In terms of daily wages, this translates to RM57.69 for a six-day work week; RM69.23 for a five-day work week; and RM86.54 for a four-day work week.

This also applies to employees who are not paid basic wages but are paid based on ‘piece rate, tonnage, task, trip, or commission.’

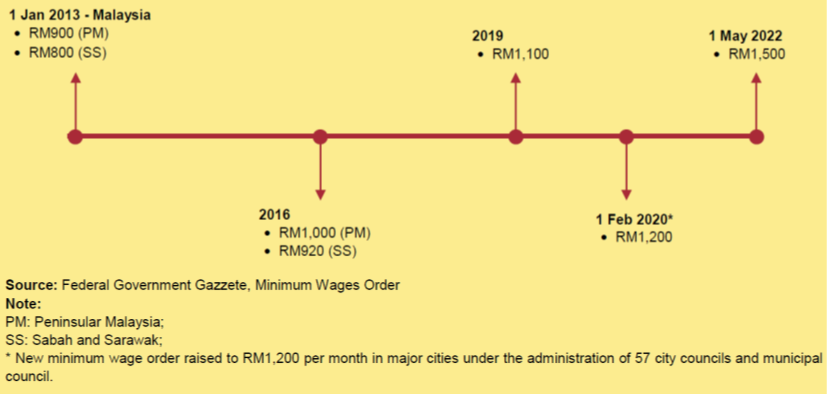

Let’s step back and look at the chronology of minimum wage implementation in Malaysia, based on Figure 1. Minimum Wage Order (MWO) was first introduced in January 2013, enforcing minimum wage rates of RM900.00 per month (or RM4.33 per hour) for Peninsular Malaysia and RM800.00 per month (or RM3.85 per hour) for Sabah, Sarawak, and the federal territory of Labuan.

The first Minimum Wage Order also had a deferred implementation date of July 2013 for employers with less than five employees. It was then revised in July 2016 to RM1,000.00 monthly in Peninsular Malaysia and RM920.00 monthly in Sabah, Sarawak, and the Federal Territory of Labuan. That translated to a minimum rate of RM4.81 per hour or daily rates of RM38.46 for a six-day work week, RM46.15 for a five-day work week and RM57.69 for a four-day work week in Peninsular Malaysia.

Consequently, a minimum rate of RM4.42 per hour or daily rates of RM35.38 for a six-day work week, RM42.46 for a five-day work week and RM53.08 for a four-day work week was implemented for Sabah, Sarawak and the Federal Territory of Labuan.

Figure 1: Chronology of minimum wage implementation in Malaysia

The Minimum Wage Order was introduced following the enactment of the National Wages Consultative Council Act 2011 (NWCC Act 2011), which was gazetted on 15 September 2011. The National Wages Consultative Council was established soon after that to advise the government on all matters related to the minimum wage.

The NWCC Act 2011 contains provisions on matters relating to the establishment of the NWCC, minimum wage order, investigation and enforcement, offences, and penalties as well as other general matters.

The Minimum Wage Order 2012 was gazetted on 16 July 2012 which enforced the implementation of the minimum wage rates on 1 January 2013 for employers with more than five workers (about 22% of business establishments), and on 1 July 2013 for employers employing five and less workers. This excluded firms that provide professional services classified under MASCO such as science and engineering, health, teaching, ICT, legal, hospitality, retail, and professionals in the services industry.

In March 2012, the National Wages Consultative Council outlined the following objectives:

1) Ensuring the basic needs of workers and their families are met.

2) Providing sufficient social protection for workers.

3) Encouraging industries to move up the value chain by investing in higher technological equipment and increasing labour productivity.

4) Reducing the nation’s dependence on foreign labour.

In January 2019, the minimum wage was initially raised to RM1,100.00 nationwide, but about a year later in February 2020, an additional category of RM1,200.00 was introduced. The RM1,200.00 rate was originally applicable to places of employment under a gazetted list of 16 city council areas and 40 municipal areas. However, from 1 February 2022, the human resources minister removed the gazetted list of city council areas and municipal areas where the rate applies. These areas were then defined according to local government laws instead (Local Government Act 1976, Local Government Ordinance 1961 [Sabah No. 11 of 1961], Local Authorities Ordinance 1996 [Sarawak Cap. 20], including Putrajaya and Labuan).

Considering the rising cost of living and the poverty-reducing effect of the minimum wage, giving an additional amount to poorer workers can help them afford the basic needs and necessities to survive. In theory, a wage increase would bring many poor people out of poverty (Dabla-Norris, Kochhar, Suphaphiphat, Ricka, & Tsounta, 2015).

People can use these resources to fulfil their educational and healthcare needs (Stoye & Zaranko, 2019), and to maintain a reasonable overall standard of living. This is theoretically appealing but may not always play out the way we imagine it to be in real life. Complex relationships exist between the minimum wage, the income of workers and their employment status as well as the incidence and depth of poverty. First, the effect of the minimum wage is not uniform across all workers (Cengiz, Dube, Lindner, & Zipperer, 2019). Therefore, it is important to determine the workers who will benefit the most from minimum wage increases and to what extent.

Figure 2: Mean monthly salaries and wages (2011-2020)

Source: Department of Statistics, Malaysia

Figure 2 shows the mean monthly salaries and wages falling for the first time in the year 2020, due to the COVID-19 pandemic. The decrease in non-citizens was in line with the recalibration of foreign labour and international border closures that year. Overall, the mean and median monthly salaries and wages of citizens were higher compared to non-citizens since most non-citizens were employed as semi-skilled and low-skilled labour.

The Malaysian Employers Federation (MEF) opposes the most recent minimum wage increase because it may reduce Malaysia’s competitiveness. However, other factors such as type of employment, location, and the economic sector involved can be considered in pursuing this further. In Malaysia, productivity does not depend on states and firms, so an alternative way to consider the relationship between wages and productivity is by looking across sectors (see Figure 3). Sectors such as logistics, distributive trade, and especially agriculture, fishing, and forestry can differ in productivity from formal firms in other sectors (see Figure 4). This situation implies that Malaysia only needs one national minimum wage policy to avoid regional bias.

Figures 3 and 4 show the profile of mean salaries and wages by economic sector for 2020. The Mining and Quarrying sector registered the highest mean monthly salaries and wages at RM4,836.00. The Services sector ranked second at RM2,981.00 while the Agriculture sector recorded the lowest mean salaries and wages at RM1,491.00. The Manufacturing sector, with mean monthly salaries and wages of RM2,407.00 in 2020, was the only sector that posted an increase in salaries and wages in 2020 compared to the previous year. The mean salaries and wages for the other sectors indicated a decline from 2019. As for the category of skill, the mean monthly salary and wages of recipients in the skilled category stood at RM4,635.00 in 2020, which was nearly three times higher than RM1,587.00 received by low-skilled employees.

Figure 3: Salaries and Wages across Sectors, 2019 & 2020.

Source: Department of Statistics, Malaysia

Figure 4: Mean monthly salary and wages across sectors and skills

Source: Department of Statistics, Malaysia

There are grounds for and against minimum wage policy. On one hand, the argument against the policy is that the minimum wage has a insignificant impact on poverty reduction due to unemployment and high inflation rates (Overstreet, 2021). The minimum wage can have short-run effects on several macroeconomic outcomes, including hours of work and employment (dependent and self-employment), inequalities in earnings and wages, and reservation wages and work satisfaction.

In the case of low-wage earners, increased hourly wages resulted in negative employment effects, while poverty and inequality could not be eradicated in the short run. Instead, it reduced the working hours, which alleviated any positive impact of a minimum wage increase (Caliendo, Wittbrodt, & Schröder, 2019).

On the other hand, the United Nations Economic and Social Commission for Asia and the Pacific (2013) is optimistic that a minimum wage policy could be a powerful macroeconomic and labour market policy instrument. If designed and implemented carefully with supportive government policy adjustments, not only does it increase incomes of workers, but it will also boost domestic effective demand and help narrow the income and earning gap. Moreover, it forces firms to improve production efficiency, hence contributing to economy-wide productivity growth and increasing competitiveness.

While higher minimum wages could have some short-term negative impacts on employment, inflation, or GDP growth, they need to be weighed against the long-term economic benefits and their positive social impacts. It is equally important for countries with minimum wage legislation to simultaneously undertake active labour market programmes in tandem with policy measures. This helps to create an enabling environment for private sector businesses, especially for SMEs, and to overcome short-term economy-wide fear of adjustment difficulties (United Nations Economic and Social Commission for Asia and the Pacific, 2013; International Policy Centre for Inclusive Growth, 2018).

Professor Dr. Loo-See Beh is with the Faculty of Business and Economics, University of Malaya. She is also a Research Fellow of the National Human Resource Centre (NHRC) of HRD Corp.

Dabla-Norris, M. E., Kochhar, M. K., Suphaphiphat, M. N., Ricka, M. F., & Tsounta, M. E. (2015). Causes and consequences of income inequality: A global perspective: International Monetary Fund.

Caliendo, M., Wittbrodt, L., & Schröder, C. (2019). The causal effects of the minimum wage introduction in Germany–an overview. German Economic Review, 20(3), 257-292. Available at: https://doi.org/10.1111/geer.12191.

Cengiz, D., Dube, A., Lindner, A., & Zipperer, B. (2019). The effect of minimum wages on low-wage jobs. The Quarterly Journal of Economics, 134(3), 1405-1454.

International Policy Centre for Inclusive Growth (2018). Minimum wage: Global challenges and perspectives. Brazil.

Overstreet, D. (2021). Is minimum wage an effective anti-poverty tool? Journal of Poverty, 1-12. Available at: https://doi.org/10.1080/10875549.2020.1869660.

Stoye, G., & Zaranko, B. (2019). UK health spending: Institute for fiscal studies. UK: The Institute for Fiscal Studies.

United Nations Economic and Social Commission for Asia and the Pacific (2013). Minimum wage policies to boost inclusive growth. Macroeconomic Policy and Development Division, No.16, August.